Annual Vendor Negotiations (AVNs) (or Joint Business Plans (JBPs) are pivotal for Amazon 1P vendors. These yearly negotiations determine pricing, trade terms, and operational strategies for the upcoming year.

For vendors, AVNs are a critical opportunity to align with Amazon on mutual goals … but the process is not without challenges. Many vendors find themselves facing mounting frustration, from unresponsive vendor managers to contentious margin protection agreements that seem to unevenly favor Amazon.

In this blog, we’ll look at the breakdown of how AVNs work, how tools like ChargeGuard can support your efforts, and why some vendors are shifting to 3P or hybrid models to regain control.

Timing, Process, and Key Players in Annual Vendor Negotiations (AVNs)

When Do AVNs Take Place?

Amazon Annual Vendor Negotiations (AVNs) typically occur annually at the beginning of the calendar year. For most vendors, the process begins in late Q4, with Amazon sending out preliminary performance reviews and trade term proposals. The bulk of the negotiations take place in Q1, often lasting several weeks depending on the complexity of the vendor’s catalog, performance metrics, and operational issues.

While the formal AVN period may conclude by the end of Q1, the agreements and terms negotiated set the stage for the entire fiscal year, meaning vendors need to be prepared to execute immediately after finalizing contracts.

How Long Do AVNs Last?

The length of AVNs varies depending on the scope of discussions, but the typical timeline includes three major phases:

1. Preparation Phase (Pre-AVN):

- Vendors and Amazon exchange performance reviews and initial proposals.

- Vendors analyze historical data, assess compliance with terms, and identify discrepancies in past financial transactions, such as overbillings or missed reimbursements.

ChargeGuard is particularly valuable during the pre-AVN phase, helping vendors uncover actionable insights from financial data and automate claims for unresolved deductions.

2. Negotiation Phase:

- Vendors and their assigned Vendor Managers (VMs) engage in discussions to address terms such as pricing structures, payment terms, marketing allowances, and operational costs.

- This phase involves multiple rounds of proposals and counter-proposals, often requiring vendors to respond to Amazon’s requests within tight deadlines (typically 5-10 days).

3. Implementation and Monitoring Phase:

- Once agreements are signed, vendors focus on executing the terms and ensuring compliance with the negotiated agreements.

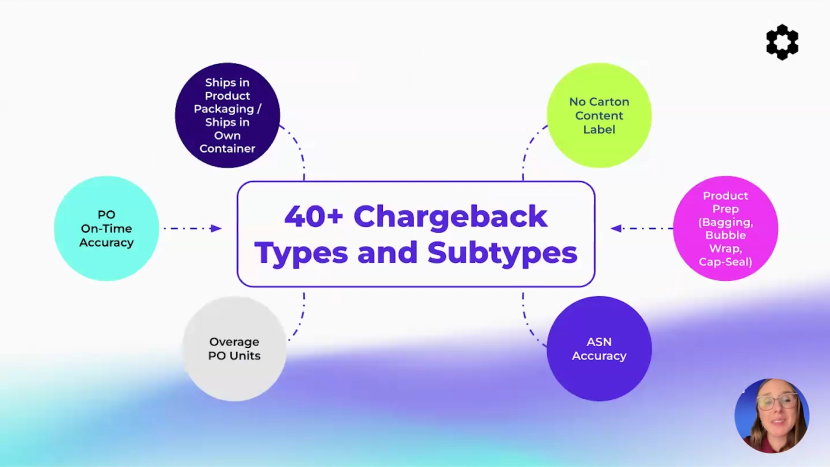

Watch this segment to understand the 40+ Amazon vendor chargeback types you should monitor after negotiations:

Who Are the Key Players in AVNs?

- Vendor Managers (VMs): Vendor Managers are Amazon employees responsible for managing the relationship between Amazon and the vendor. Their role includes:

- Reviewing vendor performance and compliance with terms.

- Proposing adjustments to pricing, allowances, and operational agreements.

- Acting as the primary point of contact for vendors during AVNs.

- Vendor Representatives: On the vendor side, negotiation teams may include:

- Sales or Account Managers: These individuals lead the discussions and advocate for favorable terms.

- Finance and Operations Teams: They provide data and analysis on profitability, costs, and operational performance.

- Legal Advisors: Some vendors involve legal counsel to review and negotiate contract terms, particularly contentious issues like CSA agreements.

- Amazon Teams: Beyond Vendor Managers, Amazon’s teams may include:

- Finance Analysts: They assess the financial implications of vendor agreements.

- Category Managers: These individuals oversee specific product categories and ensure that terms align with Amazon’s category goals.

Amazon Annual Vendor Negotiations: The Necessity and the Challenge

AVNs are high-stakes discussions that impact every aspect of a vendor’s relationship with Amazon, from pricing and cost structures to inventory management and operational compliance. The outcome of these negotiations determines a vendor’s profitability and success for the year ahead.

AVNs are intended to facilitate collaboration between Amazon and its vendors, but for many vendors, these discussions feel one-sided.

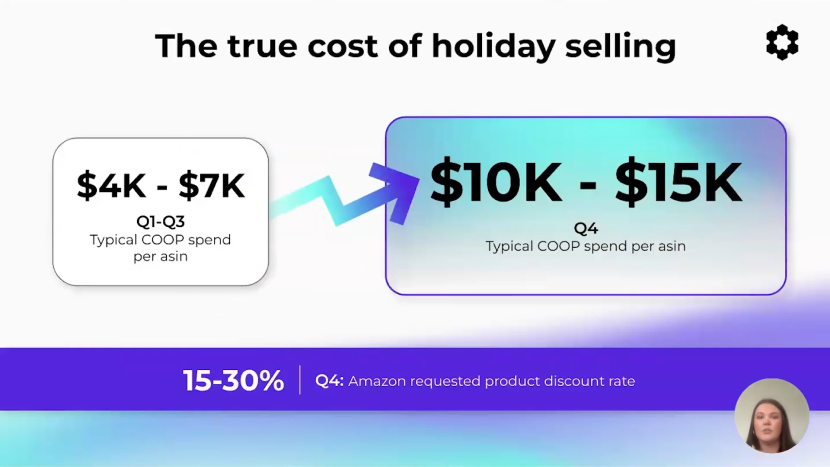

Watch this segment to understand why effective fee management is crucial during vendor negotiations:

Vendors often struggle with conversations related to price drops, margin comps, and the like, which impact their cost and competitiveness. BUT, there are strategies to achieve WIN -WIN.

Given the complexities and frustrations of AVNs, preparation and strategic execution are key. Here’s how vendors can approach these negotiations effectively:

1. Maintain Healthy MSRPs and ASPs

A sustainable MSRP strategy is critical. Maintain consistent pricing across all ecommerce platforms, including your seller account, to force Amazon to follow your desired pricing. By increasing MSRPs strategically, vendors can raise Average Selling Prices (ASPs), creating leverage to request cost increases during AVNs. However, vendors must weigh the trade-offs: Is the potential cost increase worth the possible loss in sales or market competitiveness?

2. Leverage Data for Proposals

Use detailed analytics to build a compelling case. ChargeGuard offers insights into discrepancies such as pricing shortages (PPV), inventory variances (PQV), and accrual overcharges, which vendors can use to strengthen their negotiation position. A clear, data-driven approach increases the likelihood of Amazon accepting your proposals.

3. Prepare for Timing and Trade-Offs

Timing is critical. Present cost increase requests during AVNs alongside other value-added offers, such as improved marketing allowances or supply chain efficiencies.

Vendors should also evaluate whether to create new UPCs and ASINs for products to negotiate fresh cost terms. But be wary: this approach comes with risks, such as losing established sales history and reviews.

ChargeGuard: Your Partner for Financial Clarity in Annual Vendor Negotiations

The financial complexities of AVNs, coupled with Amazon’s often opaque processes, make tools like ChargeGuard invaluable. ChargeGuard empowers vendors by identifying overbillings, automating reimbursement claims, and providing actionable insights for negotiations.

How ChargeGuard Supports Vendors During AVNs

- Recover Lost Profits: ChargeGuard identifies discrepancies in chargebacks, overbillings, and accrual allowances, with recovery rates averaging 75% and going up to 99%.

- Centralized Data Management: ChargeGuard consolidates financial data into a single dashboard, streamlining the tracking of deductions and reimbursements.

- Actionable Insights: By analyzing historical data, ChargeGuard highlights opportunities for cost recovery and strengthens vendors’ negotiation positions.

- Continuous Monitoring: ChargeGuard provides ongoing oversight to protect against future financial leakage, ensuring vendors stay ahead in the AVN process.

Watch how CHI Brands achieved $1M in revenue recovery through strategic fee management with ChargeGuard:

The Shift to 3P: A Growing Trend for Amazon Vendors

While many vendors remain committed to 1P relationships, a growing number are exploring alternatives such as 3P or hybrid models. This shift is driven by several factors:

- Increased Flexibility: Moving to 3P allows vendors to control pricing, inventory, and customer relationships without Amazon dictating terms.

- Profitability: With Amazon shifting focus to FBA fees, referral fees, and advertising revenue, some vendors find 3P more lucrative in the long run.

- More Agile Selling: A hybrid model enables sellers to select the best path based on products. For example, High margin products could be sold through 1P; low margin could be 3P.

Navigating Tough Scenarios

Many vendors share stories of standoffs with Amazon over cost increases or inventory issues. For example:

- PO Standoffs: Some vendors report being stuck in limbo with Purchase Orders (POs) that don’t reflect updated costs. Without resolution, vendors may need to halt shipments or explore alternative strategies like creating new UPCs.

- Born to Run Limitations: Challenges with Amazon’s “Born to Run” program leave products stuck in limbo, preventing natural replenishment cycles and further complicating negotiations.

- CSA Demands: Refusing CSA contracts is often the only viable option for vendors who want to avoid being financially penalized for Amazon’s pricing decisions.

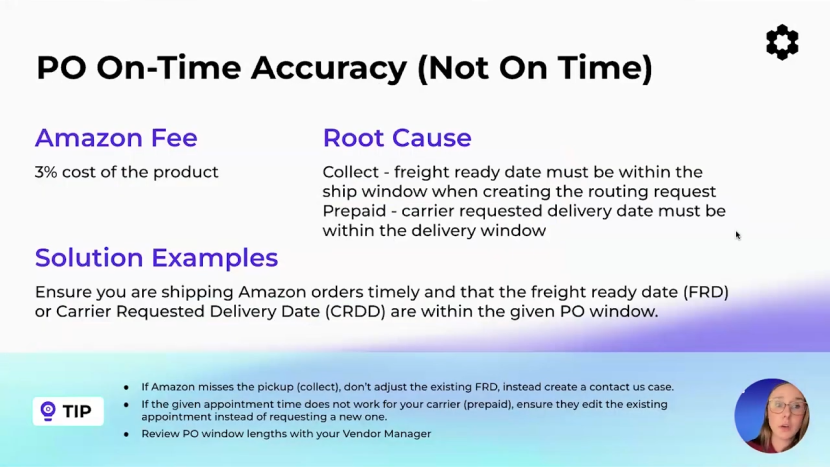

Learn more about managing PO accuracy and avoiding costly standoffs:

“Visibility is only the beginning! With actionable insights, we help vendors turn Amazon’s data into a roadmap for long-term profitability.”

– Shelby Owens, Director of Business Development at ChargeGuard.

ChargeGuard offers a safety net for vendors facing these challenges, helping them recover lost revenue and optimize future operations despite ongoing hurdles with Amazon.

Closing Thoughts: Remain Agile During AVN Season

Navigating Q4 and Q1 AVNs requires more than just product-level strategies – it demands a comprehensive understanding of Amazon’s complex ecosystem. While terms like true-ups, co-op agreements, and replenishment models can seem daunting, successful vendors know that clarity is the first step toward advantageous deals.

The most effective approach combines thorough preparation with strategic give-and-take: proactively offering balanced proposals that blend price discounts and advertising commitments while securing crucial volume guarantees for key products.

By leveraging data-driven insights, asking the right questions, and presenting holistic business solutions, vendors can transform challenging negotiations into partnerships that drive mutual growth.

With tools like ChargeGuard and a clear understanding of Amazon’s operational nuances, vendors can confidently navigate AVNs while protecting their profitability and building stronger marketplace positions.