Managing chargebacks and deductions is crucial for Amazon vendors and Walmart suppliers aiming to maintain profitability and ensure compliance with platform policies.

Chargebacks are imposed for issues like late deliveries, incorrect shipments, or packaging violations, while deductions often result from pricing discrepancies, non-compliance with promotional agreements, or inventory issues. Each of these penalties represents a direct hit to revenue, and if left unmanaged, they can accumulate quickly, drastically reducing a vendor’s profit margins.

In addition, the damage that non-compliance does to your performance metrics can lead to stricter oversight and in some cases, even the suspension of your selling privileges.

In highly competitive marketplaces like Amazon and Walmart, where margins are already tight, staying on top of chargeback and deduction management is essential.

This comprehensive guide will explore the intricacies of chargebacks and deductions, compare policies between Amazon and Walmart, and provide actionable strategies to reduce their impact on your business.

Understanding Walmart and Amazon Vendor Chargebacks and Deductions

Chargebacks and deductions are fees or penalties imposed by retailers like Amazon and Walmart for various reasons, including non-compliance with terms, operational errors, or discrepancies in orders.

While often used interchangeably, they can encompass different types of financial penalties.

- Chargebacks: Typically involve fees related to inventory issues, such as lost or damaged goods, incorrect shipments, or late deliveries.

- Deductions: Usually refer to reduced payments to vendors due to factors like pricing discrepancies, promotional allowances not met, or compliance failures.

These fees are designed to maintain operational efficiency, but they can pose significant challenges for 1P Amazon vendors and Walmart suppliers if not managed properly.

Why It’s Especially Important for 1P Vendors

For many vendors, unexpected costs from chargebacks and shortages drain profits significantly.

Research shows that nearly all Amazon vendors encounter supply chain-related chargebacks, and 90% report shortage deductions they believe are incorrect. With Amazon managing over two billion SKUs, discrepancies are inevitable.

Some large brands simply accept these losses, often writing off what could be recoverable profit. Others may not realize that these fees can be minimized or eliminated, while some know but aren’t taking action to address the issue.

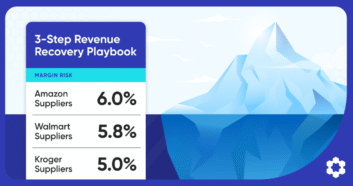

Industry estimates suggest that Amazon deductions alone can eat an average 7% of a vendor’s revenue, making it critical for vendors to tackle these avoidable costs. Reducing these deductions protects profit margins and maintains a stronger standing with Amazon and other retail giants like Walmart.

Amazon Vendor Chargebacks: A Deep Dive

Amazon vendor chargebacks are highly complex, with various types of fees that vendors need to navigate. Let’s break down the most common types.

1. Operational Chargebacks

- Labeling Errors: Failure to properly label units, cartons, or pallets with the correct barcodes or Amazon-specific identifiers.

- Packaging Errors: Non-compliance with Amazon’s packaging guidelines, including incorrect pallet dimensions, inadequate box strength, or missing protective materials.

- ASN (Advanced Shipping Notice) Errors: Errors or missing information in the ASN, which is a document sent to Amazon detailing upcoming shipments.

- Routing and Appointment Errors: When shipments are sent without following Amazon’s routing guidelines or without securing an appointment at Amazon’s fulfillment centers.

2. Shipment and Delivery Chargebacks

- Late Shipments: Chargebacks for not shipping by the scheduled time or failing to meet delivery deadlines set by Amazon.

3. Inventory-Related Chargebacks

- Expired Product: Amazon requires products with expiration dates to have a minimum shelf life remaining upon receipt. If items do not meet this requirement, a chargeback may be issued.

- Overages: Charges for sending more units than Amazon requested in a specific purchase order, leading to excess inventory.

- Non-Compliance with Temperature Control: For temperature-sensitive items that were improperly stored or delivered outside required temperature ranges.

4. Administrative Chargebacks

- Invoice Issues: Chargebacks occur if invoices are incomplete or incorrect, such as incorrect PO numbers or pricing discrepancies.

- Purchase Order (PO) Accuracy: When there’s a mismatch between the PO and the shipment contents, such as incorrect SKUs or quantities.

5. Environmental and Regulatory Compliance

- Safety and Hazard Compliance: For products that do not adhere to Amazon’s safety or hazardous material guidelines.

- Product Recall and Compliance Violations: If a vendor sends recalled products or fails to meet regulatory guidelines, Amazon may issue a chargeback.

6. Other Supply Chain Chargebacks

- Missed Freight Pickups: Amazon can charge vendors for missed pickups or for failing to follow Amazon’s freight terms if using their Partnered Carrier Program.

- Incorrect Freight Classification: When shipments are classified incorrectly (e.g., shipping as parcel when freight is required).

Each subset serves to maintain Amazon’s stringent fulfillment standards and efficiency, but it’s crucial for vendors to monitor and dispute erroneous charges to prevent unnecessary profit loss.

Amazon Vendor Deductions

Shortage Deductions

Amazon shortage claims occur when there’s a discrepancy between the quantity of products Amazon expects to receive and what actually arrives. Common causes include:

- Miscounts during packing

- Damage during transit

- Errors in shipment documentation

Pricing Discrepancies

When the cost of goods on the purchase order doesn’t match the agreed-upon terms, Amazon may issue a chargeback. This can happen due to:

- Outdated pricing information

- Miscommunication about promotional periods

- Errors in data entry

Struggling with Amazon 1P deductions? Don’t let chargebacks drain your profits. ChargeGuard can help you recover up to 99% of your fees, shortages, and accruals—automatically. Start your free audit today to see how much you could reclaim.

Walmart Supplier Deductions: A Comparison

While Amazon and Walmart share similarities in their approach to vendor (referred to as supplier on Walmart) management, there are key differences in their deduction policies.

Let’s explore the common types of Walmart supplier deductions.

On-Time In-Full Chargebacks

Walmart OTIF (On-Time In-Full) chargebacks are penalties imposed on vendors for failing to meet Walmart’s strict delivery performance standards. The OTIF program is designed to ensure that products arrive at Walmart’s distribution centers or stores on time and in the correct quantities, helping Walmart keep shelves stocked and maintain high customer satisfaction. If vendors fail to meet these expectations, they are subject to chargebacks.

Here’s how Walmart OTIF chargebacks work:

On-Time

On-Time means that shipments must arrive within the specific delivery window set by Walmart. If a delivery is early or late by even a few hours, Walmart can issue a chargeback.

If Walmart’s delivery window is scheduled for October 10th between 8 AM and 4 PM, a delivery that arrives outside this timeframe could result in a chargeback.

In-Full

In-Full means that the shipment must contain the exact quantity of products ordered by Walmart. If there are any shortages, missing items, or overages, the vendor may be penalized.

If Walmart orders 1,000 units of a product but only 950 units are delivered, the vendor can face a chargeback for the shortage.

Walmart sets a performance target for its vendors, often requiring them to achieve a high percentage of deliveries that are both on time and in full. The typical target is 90% for on time and 95% for in full, meaning vendors must hit this mark for their deliveries to avoid penalties.

Suppose a supplier delivers $100,000 worth of products, but only 89% of the shipment meets OTIF requirements, Walmart may impose a 3% chargeback on the remaining 11%, which equals $330 in fees.

Packaging and Labeling Issues

Walmart imposes fees for non-compliance with its packaging and labeling standards. This includes issues like:

- Incorrect or missing UPC codes

- Improper case pack quantities

- Non-adherence to Walmart’s sustainability guidelines

Shortages

Walmart receives fewer items than ordered on the PO. For instance, the vendor ships less inventory than the quantity ordered, resulting in a shortage.

Transportation Chargebacks

These occur when suppliers fail to meet Walmart’s transportation requirements, such as:

- Using unapproved carriers

- Failing to properly schedule delivery appointments

- Not adhering to Walmart’s routing guide

Other Types of Walmart Deductions

- Pricing Error: Pricing discrepancies between the invoice submitted by the vendor and the pricing agreement with Walmart.

- Promotional Allowances Not Met: Vendor didn’t meet the terms of a promotional agreement (e.g., special discounts or allowances for in-store or online promotions).

- Post Audit Adjustments: Adjustments made after an audit of Walmart’s purchase orders, inventory, or compliance performance.

- Unauthorized Product Returns: Walmart returns unsold or damaged goods that the vendor didn’t approve for return.

- PO Cancellation After Shipment: Walmart canceled the PO, but the vendor still shipped the items, causing overstock or unnecessary inventory.

- Invoice Not Submitted: An invoice was not submitted to Walmart, causing a discrepancy in payments.

- Unauthorized Freight Charges: Freight terms are incorrectly applied by the vendor, or Walmart was expected to handle the freight.

- Product Substitution: Incorrect product SKUs were shipped or a product was substituted without Walmart’s approval.

- Duplicate Billing: Duplicate invoices submitted for the same shipment or order.

Key Differences Between Amazon and Walmart Deduction Policies

While both retailers use chargebacks to maintain operational efficiency, there are notable differences:

- Compliance Focus: Amazon tends to have more stringent requirements around product data and catalog management, while Walmart places a heavier emphasis on supply chain efficiency.

- Dispute Process: Amazon’s dispute process is largely automated through Vendor Central, whereas Walmart often requires more direct communication with supplier managers.

- Fee Structure: Walmart’s fees are often a percentage of the purchase order value, while Amazon’s can be fixed amounts or percentages depending on the type of chargeback.

6 Actionable Strategies for Reducing Chargebacks and Deductions

Watch our webinar replay to uncover strategies that help Amazon 1P vendors mitigate Q4 fees and protect their profit margins. This video offers real-world insights on anticipating vendor fees, managing deductions, and maximizing profits in the most demanding season.

Now that you’ve seen how top 1P vendors tackle seasonal fee challenges, let’s dive into six actionable strategies you can implement to reduce chargebacks and deductions throughout the year.

1. Accurate Inventory Management

Implement smart inventory management systems like SoStocked to ensure accurate forecasting and tracking across multiple Amazon marketplaces. This minimizes discrepancies that can lead to chargebacks.

2. Timely and Compliant Shipments

Ensure that all shipments meet the deadlines set by the platforms. Use reliable carriers and track shipments to prevent delays.

For example, establishing partnerships with dependable logistics providers can help maintain on-time delivery rates, avoiding late shipment penalties.

3. Proper Packaging and Labeling

Adhere strictly to the packaging and labeling guidelines provided by Amazon and Walmart to prevent damage and ensure compliance.

Regular training for warehouse staff on packaging standards can reduce instances of packaging violations and related deductions.

4. Leveraging Data Analytics for Prevention

Data-driven insights can help you identify patterns and predict potential issues before they result in chargebacks. Consider using a tool like D8aDriven by Carbon6, which provides detailed information into your operational patterns.

For instance, D8aDriven aggregates millions of data points to give vendors a holistic view of business health, covering sales, advertising, and other KPIs. This includes both output data, which shows what happened (like sudden dips in inventory), and input data, which reveals the factors driving these outcomes (such as supplier delays).

Recognizing these patterns early allows vendors to address issues like potential stockouts or labeling inconsistencies before they lead to costly chargebacks.

5. Deduction Management and Automated Chargeback Tracking

Managing Amazon chargebacks can be complex, and third-party solutions offer essential expertise and automation to make it manageable.

Tool like Chargeguard (for Amazon vendors) streamline chargeback tracking, auditing, and reporting, providing insights that help vendors both prevent and resolve costly errors. These tools support:

- Chargeback Auditing and Dispute Management: They audit chargebacks for accuracy, handle the dispute process, and identify improvement areas to reduce recurring issues.

- Automated Tracking and Reporting: Automated systems like Chargeguard quickly identify, categorize, and generate detailed chargeback reports, enabling proactive decision-making.

The Chargeback Dispute Process

When you believe a chargeback has been incorrectly applied, it’s crucial to have a systematic approach to disputes.

Step-by-Step Guide to Disputing Chargebacks

- Review the Chargeback: Thoroughly understand the reason for the chargeback.

- Gather Evidence: Collect all relevant documentation to support your case.

- Submit the Dispute: Use the retailer’s designated system (e.g., Amazon Vendor Central) to file your dispute.

- Follow-up: Monitor the progress of your dispute and be prepared to provide additional information if requested.

- Learn and Improve: Use insights from the dispute process to prevent future chargebacks.

Best Practices for Documentation and Communication

- Maintain comprehensive records of all transactions, communications, and shipment details to support your disputes. For example, keeping digital copies of shipping receipts and correspondence can provide the necessary evidence to contest incorrect chargebacks.

- Use clear, concise language in your disputes.

- Provide evidence in the format preferred by the retailer.

- Respond promptly to any notifications of chargebacks or deductions to meet the retailer’s deadlines for disputes. Setting up automated alerts can ensure that you never miss a deadline for disputing a chargeback.

- Understand and utilize the specific dispute mechanisms provided by Amazon and Walmart to effectively challenge unjustified chargebacks.

Optimizing Vendor Performance Metrics

Your performance metrics are closely tied to your chargeback risk. Here’s how to optimize them:

Key Performance Indicators for Amazon Vendors

1. Perfect Order Percentage (POP)

The percentage of orders delivered to Amazon that meet all of Amazon’s requirements without issues.

This metric includes timely shipping, correct product labeling, accurate invoicing, and proper packaging. A high POP indicates that the vendor is fulfilling Amazon’s orders without errors. A low POP may result in chargebacks for issues such as incorrect shipments, damaged goods, or late deliveries.

Chargeback Risk: High. Common chargebacks for non-compliance (e.g., late delivery, incorrect labeling) directly affect this metric.

2. On-Time Shipment Rate

The percentage of orders shipped on or before the agreed shipping date.

Vendors must ship their products according to the date outlined in Amazon’s purchase order. Late shipments can lead to delays in receiving goods, causing operational disruptions for Amazon.

Chargeback Risk: High. Late shipments result in chargebacks for missing the delivery window, especially for time-sensitive goods.

3. Damage-Free Rate

The percentage of products that arrive without damage.If products are damaged during transit or due to improper packaging, Amazon issues chargebacks. A vendor’s damage-free rate measures their ability to ship goods that arrive intact.Chargeback Risk: Moderate. Chargebacks occur for products that don’t meet Amazon’s packaging standards or are damaged during transit.

4. Invoice Accuracy Rate

The percentage of invoices that match Amazon’s purchase orders without discrepancies.If there are discrepancies between what is shipped and the invoice, such as pricing errors, incorrect quantities, or product mismatches, chargebacks are issued.Chargeback Risk: High. Chargebacks for pricing errors or invoicing discrepancies are common when this metric is low.

5. Advanced Shipping Notification (ASN) Accuracy

The accuracy and timeliness of the electronic data interchange (EDI) notice that informs Amazon about what products are being shipped and when they will arrive.Vendors must provide an accurate ASN before the shipment arrives at Amazon’s warehouse. Incorrect or missing ASNs can disrupt receiving processes, resulting in chargebacks.Chargeback Risk: Moderate; incorrect or delayed ASNs result in administrative chargebacks.

Walmart Vendor Performance Metrics

1. On-Time In-Full (OTIF)

Walmart expects vendors to meet strict delivery windows while providing the full quantity of products ordered. Late or incomplete shipments result in chargebacks.

Chargeback Risk: High. Walmart issues penalties for both late deliveries and underfilled orders. Chargebacks often include fees for the missing percentage of products or the late arrival.

2. Fill Rate

The percentage of a purchase order that the vendor is able to fulfill. A high fill rate means that the vendor is providing the exact quantities Walmart ordered. A low fill rate could result from stock shortages or order inaccuracies.

Chargeback Risk: High. Walmart will issue chargebacks for under-fulfilled orders as they increase the risk of stockouts, impacting Walmart’s in-store and online availability.

3. Case Fill Rate

The percentage of cases that arrive at Walmart as ordered, including accurate product counts and correct labeling.

Walmart expects each shipment to be accurate not just in the total number of items but also in how they are packaged and labeled. Errors in case packing can lead to chargebacks.

Chargeback Risk: Moderate. Walmart issues chargebacks for labeling errors or if cases don’t match the purchase order (e.g., incorrect number of units per case).

4. Delivery Compliance

Tracks how well vendors adhere to Walmart’s routing and shipping guidelines, including the delivery time windows.

Vendors must follow Walmart’s instructions on how and when to ship products, using approved carriers and delivery windows. Non-compliance can result in penalties.

Chargeback Risk: High. Failure to meet delivery instructions, whether due to the wrong carrier or early/late delivery, results in chargebacks for non-compliance.

5. Defect-Free Rate

The percentage of products received by Walmart that are free from defects or damage.

This metric measures how well vendors maintain product quality during shipping and handling. High rates of defective or damaged products reduce Walmart’s ability to sell those items, leading to deductions.

Chargeback Risk: Moderate. Walmart issues chargebacks for damaged or defective products, especially if poor packaging is the cause.

6. Invoice Match Rate

Walmart expects invoices to accurately reflect what was ordered and delivered. Any discrepancies between the invoice and the PO (e.g., pricing errors) will result in deductions.

Chargeback Risk: High. Chargebacks occur frequently when there are discrepancies between the invoice and the PO due to pricing or product errors.

Tips for Improving Vendor Scorecards

1. Regular Monitoring

Performance metrics can fluctuate due to various factors like late shipments, stock shortages, or incorrect invoicing. Regularly monitoring your scorecard ensures you catch issues early before they lead to penalties or strain your vendor relationship. Without consistent oversight, small problems can snowball into large-scale operational inefficiencies.

2. Root Cause Analysis

When performance issues arise, it’s essential to go beyond just treating the symptoms and find the underlying cause. Simply addressing surface-level problems (like late shipments) without understanding the root cause (like warehouse inefficiencies) will result in recurring issues. By conducting a thorough root cause analysis, you can implement long-term solutions that will prevent similar problems in the future.

When a chargeback or deduction is issued, dig deep to determine the actual cause of the issue. Ask questions such as: Was it a carrier delay, or was the shipment packed incorrectly? Was the issue with inventory forecasting or fulfillment? Use analytics tools to track each step in the supply chain.

3. Continuous Improvement

Achieving good performance on vendor scorecards is not a one-time task; it requires ongoing attention and adaptation.

In today’s retail environment, standards and requirements evolve, new chargeback rules may be introduced, and vendor expectations may change. Implementing a culture of continuous improvement through process audits, employee training, and automation ensures that your operations stay agile and consistently meet the expectations of retailers like Amazon and Walmart.

Case Study: ChargeGuard Recovers Over $2M for a Global CPG Brand

A world-renowned Consumer Packaged Goods (CPG) brand turned to ChargeGuard to address mounting chargebacks and deductions from their Amazon vendor account. In just one year, ChargeGuard helped the brand recover over $2 million in lost revenue while supporting an 8.5% business growth.

Key Initiatives

- Historical Recovery: ChargeGuard audited past deductions, identified errors, and compiled evidence for claims, successfully recovering substantial historical shortages.

- Ongoing Disputing: By reviewing new charges and immediately submitting disputes, ChargeGuard ensured maximum and timely payouts, preventing further revenue loss.

- Root Cause Analysis: ChargeGuard analyzed the supply chain, identified two major chargeback issues, and implemented solutions that reduced future fees by 30%.

Results

Through these initiatives, ChargeGuard reclaimed over $1 million in new fees and prevented an additional $1 million in future deductions. With $2 million returned to the brand, the company was able to reinvest in growth. A pending multi-million dollar recovery from historical fees remains in process, promising even greater returns.

Future Trends in Chargeback and Deduction Management

As ecommerce continues to evolve, so will chargeback and deduction management.

Emerging Technologies

- AI and Machine Learning: Expect more sophisticated predictive analytics to help prevent chargebacks before they occur.

- Blockchain: This technology could provide greater transparency in the supply chain, reducing disputes.

Evolving Retailer Policies

- Increased Automation: Retailers are likely to further automate their chargeback processes, making it crucial for vendors to keep pace.

- Sustainability Focus: Expect more chargebacks related to sustainability practices as retailers emphasize environmental responsibility.

Take Control of Chargebacks and Deductions

Managing Walmart and Amazon vendor chargebacks and deductions is a critical skill. By understanding the different types of chargebacks, comparing platform-specific policies, and implementing actionable strategies, you can significantly reduce financial penalties and enhance your operational efficiency. A proactive approach is key.

Actionable Steps

- Audit Your Current Processes: Identify areas where chargebacks are most frequent and address the root causes.

- Invest in a Managed Solution: Implement ChargeGuard (Amazon) to enhance your chargeback management capabilities.

- Train Your Team: Ensure that all team members are aware of platform policies and best practices for compliance.

- Monitor Performance Metrics: Regularly review your fulfillment and compliance metrics to stay ahead of potential issues. Additionally, keep informed about policy changes.

- Engage with Support: Utilize platform support and tools to continuously improve your deduction management strategies.

With the right processes and tools in place, you can turn chargeback management from a constant headache into a competitive advantage.

Are you ready to take control of your chargebacks and boost your profitability? Assess your current deduction management systems and consider how tool like ChargeGuard can safeguard your bottom line.