Amazon Vendor Negotiations (AVN) can be both a challenge and an opportunity for European Amazon sellers. With growing competition, fluctuating market dynamics, and increasing demands from Amazon, vendors who approach AVN with data-driven strategies, market-specific knowledge, and well-prepared responses are better positioned to secure favourable terms that drive profitability.

In this guide, we’ll cover the various types of AVN negotiations, market-specific strategies, essential preparatory steps, tools for success, and actionable techniques to help European vendors make the most out of each negotiation cycle.

Vendor Negotiation Meaning

Held annually or on an as-needed basis, Amazon vendor negotiations focus on finalising terms such as product pricing, cost structures, payment timelines, and compliance standards.

For brands, AVN represents an opportunity to secure friendly terms that enhance profitability and logistics. For Amazon, these negotiations ensure competitive pricing and consistent supply from trusted vendors.

As a result, AVN plays a pivotal role in supply chain management by helping both parties agree on mutual goals, forecast product demand, and address challenges such as inventory management or pricing fluctuations.

Why Amazon Vendor Negotiations Are Essential

With Amazon’s European marketplace growing over 11% annually and processing over €95 billion in sales, AVN has become increasingly complex. For vendors, these negotiations are critical for locking in terms that impact product visibility, margins, and operational efficiency for the next year.

Vendors who approach AVN with a strong, data-backed plan typically achieve 15-20% better terms than those who don’t.

Understanding Amazon’s vendor terms—what’s negotiable and non-negotiable—and pCOGS is crucial for creating a robust plan. Knowing non-negotiable terms helps vendors focus on adjustable elements like pricing or payment terms, allowing them to leverage factors such as past performance or unique product advantages to strengthen their position.

Vendor Terms and Conditions

Amazon Vendor Agreements establish clear expectations and standards between Amazon and its vendors. These include:

- Product Quality: Vendors must meet stringent product quality standards that align with consumer expectations.

- Delivery Timelines: Timely delivery is critical, and penalties (Amazon vendor chargebacks) may apply for delays or incomplete shipments.

- Penalty Structures: Chargebacks, often due to late shipments or non-compliance, can significantly impact profitability.

For example, a vendor that consistently misses delivery timelines may incur substantial chargebacks. Proactively addressing such issues and negotiating operational changes can reduce these risks while fostering a more reliable relationship with Amazon.

Vendor-Neutral Agreements

Vendor-neutral refers to an approach that is unbiased and applies equally to all vendors without showing favouritism to any specific brand or supplier.

When Amazon representatives negotiate with vendors, vendor-neutral solutions and strategies are designed to create fair terms that meet company policies and market standards rather than tailoring terms to benefit a particular vendor. This approach can include data-led negotiation tools, compliance standards, or metrics that ensure all vendors are held to the same objective criteria.

Non-Negotiable and Negotiable AVN

Vendor agreements with Amazon include both non-negotiable and negotiable elements:

- Non-Negotiable: Standards for product quality, regulatory compliance, and some delivery expectations.

- Negotiable: Pricing adjustments, payment terms, and penalties for late shipments.

Focus on areas you can control. For instance, leverage strong performance metrics, such as a consistent on-time delivery record, to negotiate better payment terms or reduced penalties.

pCOGS in Amazon Vendor Agreements

Product Cost of Goods Sold (pCOGS) is central to negotiations, as it directly impacts a vendor’s profit margins. For example, vendors may need to justify higher pCOGS when presenting unique or high-demand products. Using detailed cost analysis and market data helps vendors align Amazon’s pricing expectations with their profitability goals.

Types of Vendor Negotiations

Amazon structures vendor negotiations by revenue range and complexity. Understanding these types ensures vendors align their strategy with the right expectations:

| Negotiation Type | Revenue Range | Timeline | Key Characteristics | Success Metrics |

|---|---|---|---|---|

| Local | Under €5M | 30 days | Single-market focus, standard terms | 65% success rate |

| Coordinated | €5M-€20M | 45 days | Multi-country alignment, cross-border terms | 8-12% improvement |

| Managed | Over €20M | 60-90 days | Pan-European terms, dedicated account management | 15-20% better terms |

Vendors operating in multiple European markets can achieve better outcomes by participating in Coordinated or Managed negotiations, which offer greater flexibility.

Stages of the Vendor Negotiation Process

1. Initial Preparation

In the initial preparation stage, vendors review key factors that will shape their negotiation strategy, including past performance, existing contract terms, and current market trends.

For example, a vendor might analyse their performance metrics in Amazon Vendor Central, such as sales growth, on-time delivery rates, and compliance history, to understand their leverage points.

Additionally, they’ll assess the terms of the existing contract—particularly pricing, payment terms, and penalty structures—and compare these with broader industry standards and recent market shifts.

If raw material costs have risen significantly, for instance, this data will support a request for price increases or adjustments to payment timelines. The goal here is to enter negotiations well-prepared, with data that justifies any proposed changes.

Catalog Review and Strategic Selection

When preparing for Annual Vendor Negotiations (AVNs), thorough catalogue review and selection is critical to positioning your business for success. Vendors must evaluate their performance metrics to strengthen their negotiation strategy, ensuring they’re prepared to meet the demands of Vendor Managers (VMs), who often focus on maximising margin gains without committing to volume guarantees. Here’s how vendors can refine their catalogue approach:

- Discount High-Margin ASINs

Prioritise offering discounts on high-margin ASINs to create leverage in negotiations. This strategy provides VMs with the price reductions they seek while maintaining profitability for your business. Highlighting these products allows you to maintain a stronger position when discussing other terms. - Leverage for Volume Commitments

Use high-margin ASIN discounts as a trade-off to secure volume commitments from VMs. By aligning their needs for competitive pricing with your goals for guaranteed sales volumes, you create a mutually beneficial agreement that drives operational stability. - Delist Low Sell-Through ASINs

Evaluate ASINs with poor sell-through rates and consider delisting them to streamline your catalogue. Focusing on top-performing products not only improves overall catalogue efficiency but also allows you to allocate resources more effectively, enhancing inventory and cash flow management. - Prepare Data for High-Volume, Low-Margin ASINs

For high-volume, low-margin ASINs, it’s essential to have data that justifies your pricing strategy. Analyse and present metrics such as production costs, logistics expenses, and historical performance to defend your floor price. This data-driven approach helps counter unreasonable pricing demands from VMs. - Review Return Rates, Chargebacks, and Compliance Issues

High return rates, chargebacks, and compliance violations can erode profitability and negotiation leverage. Review these metrics thoroughly and develop clear plans of action (POAs) to demonstrate ongoing improvements. This proactive approach reassures VMs that your catalogue is optimised for operational efficiency and customer satisfaction.

By addressing these key areas, vendors can present a well-prepared, data-backed catalogue that aligns with their business goals while meeting the expectations of Vendor Managers. This strategy not only strengthens your negotiating position but also ensures your catalogue is optimised for profitability and growth.

2. Submission Phase

In this stage, the vendor formally presents their requests for adjustments to the Amazon vendor contract. This can include proposing price hikes, revised payment terms, or changes to delivery expectations.

If production costs have risen by 10%, the vendor may submit a request for a corresponding price hike to maintain their profit margins. In this submission, vendors often include detailed documentation or cost analyses to justify their requests, reinforcing the rationale behind each proposed change. This step sets the tone for the negotiation, outlining the vendor’s goals and priorities.

3. Review and Negotiation

After receiving the vendor’s submission, Amazon reviews the requests and provides feedback or counter-proposals. This phase is often the most interactive, involving back-and-forth communication as both parties work to reach an agreement.

Amazon might counter a vendor’s price increase request by offering a smaller increase or proposing extended payment terms instead. Vendors may need to negotiate further by presenting additional data, such as evidence of cost increases or product demand, to support their initial request.

This stage requires flexibility, as vendors often need to weigh Amazon’s counteroffers against their goals to arrive at a mutually acceptable solution.

4. Finalisation

Once both parties agree on the new terms, the contract is finalised and updated in Amazon Vendor Central. This may involve updating pricing, payment terms, or delivery conditions in the system, ensuring all details are accurately reflected and accessible for ongoing transactions.

Finalisation is critical because it ensures that the agreed-upon terms are officially recorded and can be referenced in future interactions. Suppose a new pricing structure was negotiated, then it will now be visible in Amazon Vendor Central for all future purchase orders.

At this stage, both Amazon and the vendor have a clear, documented basis for their partnership moving forward.

Preparing for AVN: Key Steps and Strategies

Preparation for the vendor negotiation process is essential. Successful suppliers often begin preparation months in advance to thoroughly assess their strengths, vulnerabilities, and the market landscape.

Here’s a Preparation Checklist for Successful AVN:

- Conduct a Financial and Operational Review:

- Review historical sales, margins, and chargebacks.

- Use ChargeGuard to analyse chargeback patterns for Amazon vendors.

- Understand Market-Specific Dynamics:

- Research the regulatory and competitive nuances of each European market you’re targeting.

- Tailor your negotiation strategies to each country’s consumer behaviours.

- Create a Risk Mitigation Plan:

- Develop a plan to address operational, financial, and market risks.

- Map Out Negotiation Scenarios:

- Plan responses to Amazon’s typical requests, such as margin improvements or extended payment terms.

- Gather data from past performance to support your counteroffers.

- Use Amazon vendor help and resources to navigate complex contract terms, address logistical challenges, and resolve compliance issues. Amazon provides several dedicated support channels within Vendor Central to help vendors troubleshoot common issues, access valuable information, and receive guidance on negotiation topics.

Start preparing for AVN several months in advance to allow for detailed market research and scenario planning. Well-prepared vendors achieve 10-15% more favourable terms.

Common Pitfalls to Avoid in AVN Preparation

- Failing to Segment Strategy by Market: A one-size-fits-all approach rarely works across different European markets. Avoid generalised strategies, especially if selling in multiple countries with unique customer expectations.

- Overestimating Margin Flexibility: Be realistic about your margins before offering concessions. Many vendors overpromise, later realising that the terms are unsustainable.

- Skipping Risk Planning: Chargebacks, product returns, and fluctuating demand can greatly impact your profitability. Make sure you address these potential risks early on.

Avoid committing to terms that may strain profitability long-term. Have a clear margin threshold to guide your decisions.

Leveraging Technology for Indirect Negotiation Support

Although ChargeGuard don’t directly engage in vendor negotiations, they provide essential support by enhancing a vendor’s financial standing and operational reliability.

Here’s how each tool strengthens your negotiation position.

ChargeGuard: Essential for Amazon Chargeback Recovery

ChargeGuard is specifically designed to help Amazon vendors manage and recover funds lost to chargebacks, automating disputes for issues like pricing discrepancies or shipping errors. By improving cash flow and minimizing revenue losses, ChargeGuard indirectly supports negotiation efforts.

How ChargeGuard Supports Negotiations

- Financial Health: Recovering chargebacks means vendors maintain a stronger cash flow, which helps when discussing terms like payment timelines or discounts.

- Data-Driven Adjustments: ChargeGuard’s reporting reveals chargeback patterns, enabling vendors to correct operational issues. This proactive approach strengthens a vendor’s position by demonstrating reliability and operational consistency.

Case Study: ChargeGuard’s Strategy for a 668% Settlement Increase

ChargeGuard boosted a client’s settlement from Amazon by an impressive 668%, recovering over $640,000 more than Amazon’s initial offer. This achievement was driven by three key strategies.

- ChargeGuard leveraged deep industry expertise, going beyond automation to compile robust evidence and build strong cases for Amazon shortages.

- The team then applied advanced negotiation tactics, identifying errors and strategically escalating issues to maximise the outcome.

- Lastly, ChargeGuard emphasised relationship management, focusing on creating a healthy, long-term relationship with Amazon that supports ongoing business growth.

Through this combination of negotiation, expertise, and relationship building, ChargeGuard bridged the gap between what the client was initially offered and what they were rightfully owed.

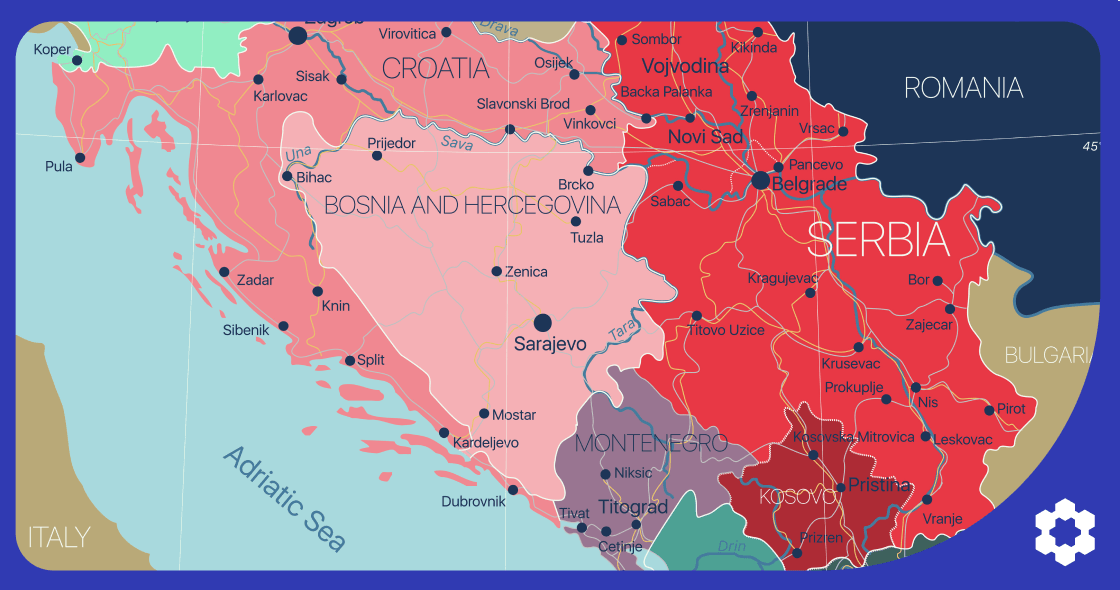

In-Depth Market Insights: Strategies for Key European Markets

Adapting negotiation strategies to the intricacies of each European market can lead to significant advantages. Below are specific strategies tailored to major European markets:

Germany: Efficiency and Logistics Focus

Due to high competition and price sensitivity in Germany, vendors should:

- Emphasise Operational Efficiency: Position operational efficiency as a competitive edge. Highlight investments in logistics or supply chain improvements that reduce lead times.

- Focus on Bundle Offers: Bundling can reduce perceived product costs and appeal to price-sensitive buyers, which can be a persuasive argument during negotiations.

UK: Localised Fulfilment and Brexit Compliance

With post-Brexit challenges, emphasise:

- UK-Based Fulfilment Solutions: Offering local fulfilment capabilities not only reduces logistics costs but also aligns with UK customer expectations for quick delivery.

- Customs and Regulatory Compliance: By showing your compliance with post-Brexit regulations, you can reinforce reliability, a valuable trait for Amazon partnerships.

France: Seasonality and Pricing Strategy

In a market with strong seasonality and pricing regulations:

- Seasonal Product Planning: Highlight strategies for managing seasonal peaks, such as streamlined returns during high-return periods like holiday sales.

- Price Compliance: Ensure your pricing strategies align with France’s pricing regulations. This compliance can be a point of differentiation and help avoid potential legal issues.

Italy and Spain: Regional Marketing and Cash Flow Management

Both countries have unique purchasing behaviours:

- Regionalized Marketing Campaigns: Demonstrate an understanding of regional preferences and use localised marketing to stand out.

- Flexible Payment Terms: Due to traditionally longer payment cycles, be prepared to negotiate flexible payment terms while maintaining cash flow.

Adapt to each European market’s regulatory and consumer behaviour to maximise negotiation potential. For instance, in Germany, emphasise logistical efficiency, while in France, prioritise seasonal planning.

Building Long-Term Success in Amazon Vendor Negotiations

Success in Amazon Vendor Negotiations requires a blend of preparation, data, and market-specific insights. Here’s how to ensure long-term success:

1. Leverage Data to Back Every Term You Negotiate

Analyse historical data from sales, margins, and chargebacks to identify areas for improvement. Use tool like ChargeGuard (for Amazon) to simplify deduction management and monitor trends. With clear data, you can justify margin requests or negotiate better payment terms, backed by solid metrics.

2. Tailor Negotiations to Each European Market

European markets vary significantly. Vendors who customise strategies for specific regions like Germany or France achieve better terms by aligning with local regulatory and customer expectations. Stay agile and adapt your negotiation approach to maximise regional advantages.

3. Prepare Responses for Key Negotiation Scenarios

Pre-plan responses to common Amazon requests—such as demands for margin improvements or extended payment terms. Having a set of data-backed counteroffers ensures you’re ready to negotiate on your terms, not theirs.

4. Optimise Operations to Reduce Disputes

Use ChargeGuard to identify and correct recurring chargeback issues, improving operational efficiency and reducing potential conflicts.

5. Focus on Long-Term Relationship Value

A successful AVN strategy isn’t just about securing better terms today; it’s about building a reliable track record with Amazon. Regularly track performance metrics like fulfilment rates and chargebacks to show consistent reliability and a low-risk profile, making Amazon more likely to offer favourable terms over time.

In sum, following these steps and using the right tools to stay financially sound and operationally efficient enables European Amazon vendors to improve their AVN outcomes and build a sustainable, profitable relationship with Amazon.