This week’s Amazon seller news roundup brings updates that are set to improve both the shopping and selling experience on the platform.

First, Amazon’s enhanced homepage now offers a more personalized shopping experience, making it easier for customers to discover products more tailored to their preferences. In addition, Amazon is testing a feature that displays seller ratings directly in search results, providing shoppers with quick insights into seller reliability before clicking through.

In a move that could shake up the market, Amazon is reportedly developing a low-cost storefront to rival popular platforms like Temu.

On the logistics front, Amazon Today, the same-day delivery service from local stores, is coming to an end. However, the company is expanding same-day delivery options to 80 towns and cities across the UK to meet growing demand.

Stay tuned as we dive deeper into these updates and explore how they can impact your Amazon business. With these changes, you’ll gain insights into improving customer experience and optimizing your seller operations.

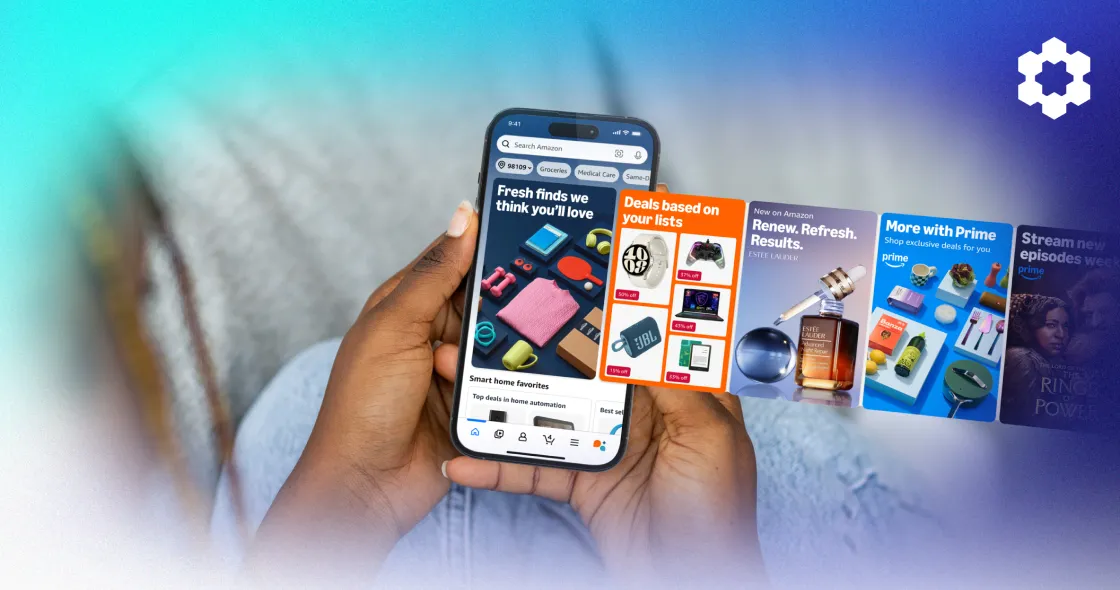

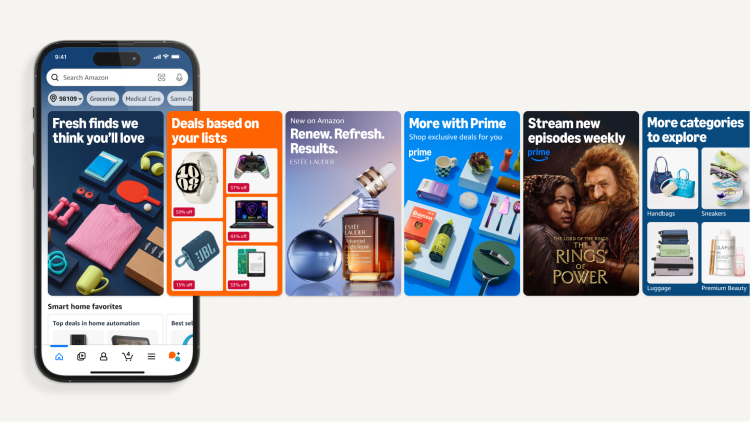

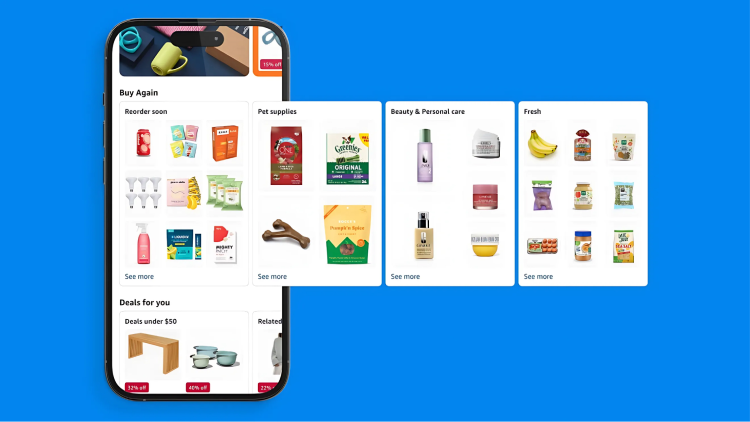

1. Amazon Shopping App’s Revamped Homepage Aims to Make Shopping Easier and More Personalized

Amazon is rolling out a series of updates to its shopping app homepage, designed to create a more personalized and intuitive shopping experience just in time for the holiday season.

By combining AI with improved navigation, Amazon aims to help customers find what they need faster while introducing them to new products based on their unique shopping habits. This latest redesign, which is currently being tested on millions of customers in the US, brings a refreshed look and feel to the Amazon app on iOS and Android.

Personalized Shopping and Improved Navigation

The biggest change shoppers will notice is how the homepage feels more tailored to their preferences. The new layout uses AI-powered personalization to suggest products based on previous purchases and browsing behavior.

If a shopper recently bought kitchenware, they might now see matching utensils, cookware, or trending kitchen gadgets. Amazon is also experimenting with more vibrant product groupings and dynamic curations, which will make it easier for customers to explore relevant categories without jumping between pages.

Window Display

The redesign emphasizes horizontal scrolling, allowing users to browse collections such as deals, new releases, or best-sellers without leaving the page.

A “Window Display” at the top of the homepage greets users with personalized recommendations that include products and services from across Amazon—whether it’s picking up where they left off or showcasing something new based on their habits. This feature might show a sports fan the latest gear and fitness gadgets, while movie lovers may see the newest Prime Video releases.

Buy Again Hub

In response to user feedback, Amazon is also making it simpler for customers to reorder frequently purchased items. The new “Buy Again” hub consolidates regularly bought products in one easy-to-access place. Whether it’s household goods or favorite snacks, reordering essentials is just a tap away, saving time and reducing friction in repeat purchases.

User Reactions to the Changes

While Amazon’s updates aim to simplify the shopping experience, customer feedback has been mixed.

Some appreciate the effort to improve personalization, but others remain skeptical about the app’s overall design. A user on The Verge commented, “Amazon works, but jesus christ their design is ugly.”

Another mentioned that despite tweaks, the experience can feel disorganized due to the overwhelming number of products. “There’s really nothing you can do with Amazon’s catalogue. It’s too vast to ever make it enjoyable,” the user remarked, highlighting the challenge of managing such a vast array of products while keeping the interface user-friendly.

Others have suggested Amazon should focus more on improving the app’s performance, as some shoppers find the interface laggy and cluttered with irrelevant products.

“They should work on making the whole app not feel like a laggy piece of garbage instead,” one user wrote. Additionally, some users noted the frustration of navigating a marketplace filled with low-quality products, with one commenter saying, “Different look doesn’t matter much, if the whole store is filled with cheap Chinese garbage.”

The Future of Amazon’s Shopping Experience

Amazon is betting that these incremental updates will not only make shopping faster and more efficient but also encourage users to discover new products. The goal is to keep customers engaged by surfacing items that align with their tastes and preferences, ultimately leading to higher customer satisfaction and, naturally, more sales.

As Amazon continues to test these features, more US customers will see the updates over the coming months. Whether you’re a shopper looking for personalized recommendations or a seller hoping to get your products in front of more eyes, these changes represent an evolving landscape in ecommerce that puts user experience at the forefront.

For those invested in selling on Amazon, staying ahead of these updates can provide an edge in capturing the attention of potential customers during a crucial time for online shopping.

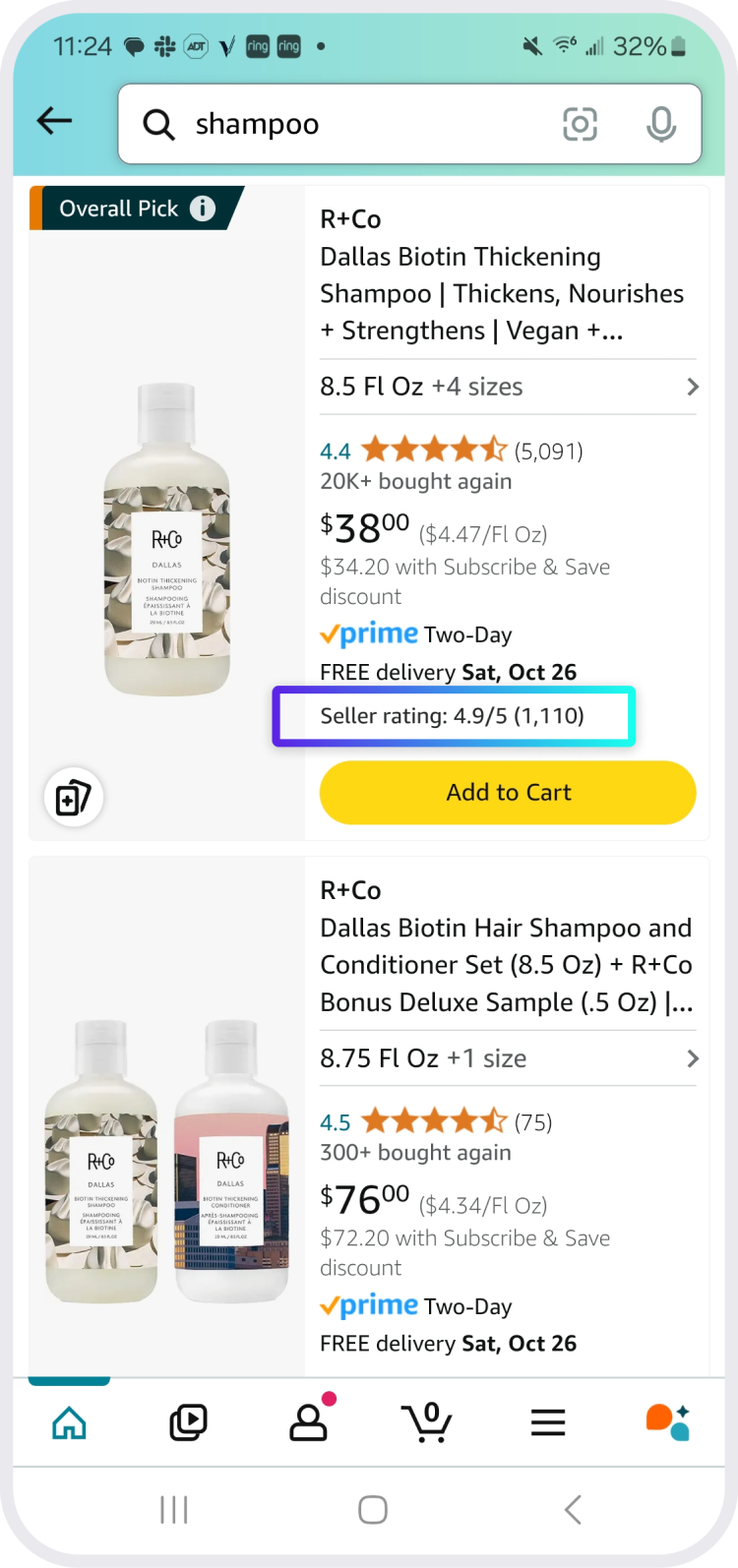

2. Amazon’s Latest Experiment: Seller Ratings Displayed in Product Search Results

Amazon is testing a new feature that could alter the way customers and sellers interact on its platform. The tech giant has begun showing seller ratings directly within product search results, adding a new layer of transparency and detail to the shopping experience.

This experiment is being released selectively on Amazon’s mobile app, and its implications could be huge for both shoppers and third-party sellers.

What Are Seller Ratings?

Traditionally, Amazon shoppers have been accustomed to seeing product ratings displayed on search results—those little yellow stars that indicate how customers feel about a particular item.

But now, in addition to product ratings, some customers are also seeing a seller rating listed under the Prime badge in search results. This number, ranging from zero to five, reflects the seller’s overall performance and the number of seller feedback ratings they’ve received in the last 12 months.

Products sold directly by Amazon, however, do not display this seller rating. Instead, Amazon assures customers that the product is “Sold by Amazon.” This distinction highlights Amazon’s ongoing effort to separate itself from third-party (3P) sellers, even though over 60% of sales on its platform come from independent sellers.

Why This Matters for Shoppers

This update is designed to help customers make more informed decisions by showcasing not just the quality of the product but also the reputation of the seller.

In a world where fraudulent or unreliable sellers can easily pop up on massive ecommerce platforms, having this additional layer of transparency is crucial.

Vanessa Hung, SellerAssist by Carbon6 Co-Founder, remarked on the change in a LinkedIn post, saying, “The interesting thing about this is that now customers can decide if we have the ideal product and if we are the best seller to buy from.”

Her comment reflects a sentiment shared by many sellers: this new feature could enhance credibility and reward those who prioritize customer service.

For consumers, this change means that they can evaluate not only the product but also the seller’s ability to deliver a smooth buying experience. Whether it’s timely shipping, helpful customer support, or the quality of the packaging, the seller rating can offer insights that complement the product reviews already in place.

However, there are questions about how much impact this new information will have on consumer behavior.

Gwen McShea, President of Lean Edge Marketing, points out in an interview with Modern Retail that “customers aren’t yet trained to take seller ratings into account,” which means this could either become an essential part of the decision-making process or something that fades into the background as “white noise.”

Impact on Sellers

For Amazon sellers, especially those competing for the coveted “Buy Box,” this new feature presents both a challenge and an opportunity.

Winning the Buy Box often leads to significantly more sales, and now seller ratings play a visible role in that process. Sellers who maintain strong customer service records stand to gain an edge, while those with lower ratings could struggle.

Use AMZ Alert to manage and track changes to your listing, handle negative reviews, monitor the fluctuation of your Buy Box status, keep an eye on product suppression and takedowns—all from a centralized monitoring dashboard.

In a statement to Modern Retail, Jon Elder, CEO of Black Label Advisor, sees this as a positive development for serious sellers. “Sellers are very happy about this change because it will help the legit brands convert more customers.”

Jason Boyce, Founder of Avenue7Media, agrees, noting that it will likely push bad actors out of the spotlight. “A company that has a lot of good, well-meaning seller ratings should have an opportunity to win the Buy Box over another one who may be a little bit lower in cost but has poor ratings,” he added.

However, maintaining a high seller rating requires vigilance. Poor seller performance can easily result in losing sales to better-rated competitors. Luckily, Amazon helps sellers by removing feedback unrelated to the buying experience, such as complaints about late deliveries that were outside the seller’s control. This can be especially beneficial for those using FBA, as Amazon takes responsibility for shipping-related issues.

Judah Bergman, CEO of Jool Baby, a seller of baby products on Amazon, highlights the rarity of seller feedback compared to product reviews. His brand has over 10,000 seller ratings, but individual products often receive more than double that amount in reviews.

“If they leave negative feedback, often it’s a product review,” Bergman said, underscoring the challenge for sellers to gather positive seller ratings.

What’s Next?

While Amazon has not confirmed whether this change is permanent, it’s clear that the company is continuously experimenting with how it presents information to shoppers. The seller rating feature has the potential to enhance the transparency of the marketplace, benefiting both shoppers and high-performing sellers.

But as McShea points out, much will depend on whether consumers actually take these ratings into account when making purchases.

For now, sellers should take note of the growing importance of maintaining high ratings and delivering exceptional service, as it could directly impact their visibility and sales. Whether this feature becomes a permanent fixture or just another short-term experiment, it’s a reminder that Amazon’s marketplace is constantly changing, and both shoppers and sellers need to stay adaptable.

3. Amazon Takes Aim at Low-Cost Rivals with New Discount Storefront

Amazon is reportedly gearing up to launch a new low-cost storefront aimed at competing with platforms like Temu and AliExpress, known for offering rock-bottom prices on consumer goods.

This move represents a major change for Amazon as it ventures into the discount ecommerce space, a market that has seen rapid growth, thanks to the success of Chinese platforms.

Amazon’s New Discount Store: What We Know

According to reports from The Information and Engadget, Amazon plans to launch a budget-focused platform that will sell low-cost items directly from suppliers in China to US customers.

Products will be shipped from a fulfillment center in Guangdong, China, and sellers will be subject to strict price caps on various product categories.

For instance, the proposed price caps include:

- Jewelry: $8

- Bedding: $9

- Guitars: $13

- Sofas: $20

These price limitations mark a departure from Amazon’s usual model, where sellers have the freedom to set their own prices. The company is reportedly targeting 700 specific items for the platform’s launch, focusing on everyday low-cost products that are popular on discount platforms like Temu, Shein, and AliExpress.

The Strategy Behind the Move

This initiative comes as Amazon faces increasing competition from fast-growing discount retailers like Temu, which have gained a reputation for offering ultra-low prices, albeit sometimes with questionable quality and slower shipping times. Amazon’s new platform appears to directly compete by offering similar prices but with the added benefit of Amazon’s logistical expertise.

However, customers who purchase from this low-cost storefront will experience longer shipping times—ranging from nine to 11 days—due to international fulfillment. In exchange for the lower prices, sellers will pay reduced fulfillment fees compared to Amazon’s main marketplace.

According to The Information, shipping a 4-8 ounce item from the new low-cost store could cost sellers between $1.77 and $2.05, way lower than the $2.67 to $4.16 charged for the same item shipped from a US fulfillment center under FBA.

A Shift in Amazon’s Ecommerce Strategy

Historically, Amazon has not imposed price restrictions on its main platform, allowing sellers the flexibility to determine prices based on competition, demand, and product quality.

This new approach signals a marked change in how Amazon plans to cater to consumers who are increasingly price-sensitive. During Amazon’s Q2 earnings call in August, CEO Andy Jassy noted that customers have been “trading down” on price as inflation and economic uncertainty continue to influence shopping behavior.

By launching a separate discount platform, Amazon is likely aiming to capture a broader segment of budget-conscious consumers who are looking for the lowest prices possible, even if that means waiting longer for delivery.

This also aligns with broader trends in consumer spending, where demand for big-ticket items has slowed as shoppers prioritize essentials over high-cost purchases.

A Boost for Chinese Sellers

The new platform is expected to attract many Chinese suppliers, many of whom already sell on similar marketplaces like Temu, Shein, and AliExpress.

At a conference for Chinese sellers in June, Amazon reportedly pitched the low-cost store as an alternative to these competitors, offering the opportunity to reach US customers under the trusted Amazon brand.

For sellers, while the lower fulfillment fees and access to Amazon’s vast US customer base are clear advantages, the strict price caps could limit profitability. Sellers will need to focus on cost efficiency and volume to make this model work.

Effortlessly aggregate your business data from multiple sources into a unified dashboard with D8aDriven. Gain comprehensive insights into your sales, marketing, operations, and finance, empowering you to make informed decisions quickly and effectively.

Will It Revitalize Amazon’s Sluggish Ecommerce Growth?

Amazon’s ecommerce business has experienced slower growth in recent quarters, and some sellers have reported a drop in sales in 2024.

The introduction of a low-cost storefront could be Amazon’s response to this stagnation. By focusing on budget-friendly items, Amazon can tap into a consumer base that prioritizes low prices, especially in the face of ongoing economic uncertainty.

While the platform may initially focus on low-cost goods, it has the potential to expand into other categories if successful. Given Amazon’s dominance in logistics and its massive seller ecosystem, the new storefront could pose a serious challenge to Temu and other discount competitors, potentially reshaping the low-cost ecommerce market.

Balancing Price and Quality

Amazon’s foray into the discount market is a bold move aimed at competing with platforms like Temu, which have rapidly gained popularity by offering ultra-low prices. Setting strict price caps and leveraging its fulfillment network in China allows Amazon to attract budget-conscious consumers and revive its ecommerce growth.

While the platform could prove a boon for sellers and shoppers alike, the success of the initiative will depend on Amazon’s ability to balance low prices with product quality and delivery efficiency.

4. Amazon to End ‘Amazon Today’ Same-Day Delivery, Focuses on Expanding Fast Shipping Network

Amazon is set to discontinue its Amazon Today same-day delivery service, which allowed customers to receive products directly from local retail stores. The service will officially end on January 24, 2024, as the company streamlines its fast-shipping offerings to reduce overlap between its delivery programs.

What Was Amazon Today?

Launched in 2022, Amazon Today allowed Prime members to order products from a selection of retailers, including brands like PacSun, GNC, and SuperDry, with the promise of same-day delivery. By partnering with brick-and-mortar stores, Amazon used local retail inventories to offer customers rapid delivery options and in-store pickup services.

The service aimed to provide a wider range of products at fast delivery speeds by leveraging the physical stock of local stores. However, strict operational requirements were placed on participating retailers. To maintain a 99% pickup readiness rate, stores had to ensure orders were picked, packed, and ready for Amazon couriers within one hour of an order notification.

Despite its ambitious goals, the program saw limited success. By shutting it down, Amazon can consolidate its fast delivery services into more cohesive and efficient offerings.

The End of Amazon Today

An Amazon spokesperson interviewed by Supply Chain Dive cited “growing overlap” between Amazon Today and its other fast delivery programs as the main reason for discontinuing the service.

Although the program will no longer exist after January, most of the products previously available on the platform will still be offered through other same-day and next-day delivery methods. This move is part of a broader effort to simplify Amazon’s complex web of fulfillment options and focus on scaling its core shipping infrastructure.

The approximately 175 employees working on the Amazon Today project will be reassigned to other positions within the company, minimizing the impact on personnel.

What’s Next for Amazon’s Fast Delivery?

While Amazon is phasing out Amazon Today, it remains committed to expanding its same-day delivery network.

During Amazon’s August earnings call, CEO Andy Jassy emphasized that the company continues to innovate in fast delivery. More than 5 billion items have been delivered on the same day or next day for Prime customers globally in 2024, with the company’s delivery speeds “faster than ever before.”

In the UK, for instance, Amazon has rapidly expanded its same-day delivery services, now covering more than 80 towns and cities, including Aberdeen, Plymouth, and Middlesbrough. The demand for same-day delivery has surged, with the number of products ordered for same-day delivery more than doubling since last year.

According to Amazon, some of the most popular products ordered on the same day during its latest Prime Day event included Amazon Fire TV sticks in Manchester, hydrating serum in Nottingham, and ink cartridges in Swansea. This demonstrates a growing consumer appetite for fast and convenient shopping, with quick access to everyday essentials becoming a key selling point for Amazon Prime.

A Shift in Amazon’s Focus

The closure of Amazon Today reflects Amazon’s commitment to refining its fast delivery offerings by focusing on more scalable solutions.

With same-day and next-day delivery becoming central to its logistics strategy, Amazon is likely to continue investing in its core delivery infrastructure while exploring other new ways to meet consumer demands for speed and convenience.

For retailers, the end of Amazon Today marks a pivot from local store inventory integration toward a more centralized approach to fast shipping. This may also encourage businesses to explore partnerships with Amazon’s other fulfillment programs, such as FBA, which has a broader reach and more established logistics.

For customers, the impact will be minimal, as the majority of products offered through Amazon Today will remain available via other Amazon same-day or next-day services. However, the convenience of getting items from local stores may be missed by those who relied on that specific service.

Strategic Shift Toward Enhanced Delivery Efficiency

Amazon’s decision to end its Amazon Today same-day delivery program is part of a broader effort to streamline its fast shipping options and focus on expanding its same-day and next-day delivery network. While the program saw initial promise by leveraging local stores’ inventories, it struggled to differentiate itself from Amazon’s other fulfillment offerings.

As Amazon invests in cutting-edge technology and expands its delivery network across the globe, the company’s commitment to faster, more efficient shipping remains clear. Customers can continue to enjoy the benefits of quick deliveries, while retailers may need to change their strategies to stay in sync with Amazon’s expanding logistics model.

Seizing Opportunities: Thriving Amidst Amazon’s New Features

In light of Amazon’s continual advancements, it’s essential for sellers to adapt in order to remain competitive. The recent improvements, which include a more personalized shopping interface, the integration of seller ratings in search results, a new low-cost storefront, and the termination of the Amazon Today same-day delivery service, offer sellers both challenges and opportunities.

Here are actionable steps to ensure you remain ahead of the curve:

- Embrace Personalization: With Amazon’s revamped homepage focusing on tailored recommendations, consider optimizing your product listings with high-quality images and engaging descriptions that resonate with your target audience. This could enhance your visibility as customers discover products aligned with their preferences.

- Monitor Seller Ratings: As seller ratings become visible in search results, prioritize exceptional customer service to build a strong reputation. Actively encourage satisfied customers to leave positive feedback and promptly address any concerns to maintain a high seller rating. AI-powered solutions like SellerTools and AMZ Alert by Carbon6 can help streamline feedback management, making it easier to track and respond to customer reviews effectively.

- Adapt to Low-Cost Competition: With Amazon venturing into the low-cost storefront arena, it’s crucial to evaluate your pricing strategy. If you compete in similar product categories, consider how you can differentiate your offerings, whether through quality, unique features, or customer service. Utilize Carbon6’s tools like ManageByStats and D8aDriven to analyze market trends and optimize pricing strategies accordingly.

- Leverage Logistics Solutions: As Amazon phases out the Amazon Today service but expands its same-day delivery options, ensure you are using the right fulfillment strategy. If you’re not already using FBA, consider integrating it to improve your shipping capabilities.

- Stay Informed and Flexible: Amazon is continuously testing new features and strategies. Regularly check updates from Amazon and industry sources to stay informed about changes that may impact your selling strategy. Engage in communities and forums where other sellers share insights and experiences, helping you remain adaptable in this dynamic environment.

Taking these proactive actions will allow you to not only keep up with Amazon’s changes but also solidify your standing in the market.

Utilizing Carbon6’s suite of tools will also further streamline your operations, allowing you to focus on what matters most: growing your business and enhancing the customer experience.

Stay agile and make these updates work for you to ensure sustained success on Amazon.